Who are Ultra-Rich?

Let’s take a closer look at the ultra-rich in our country.

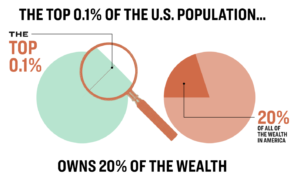

First, a definition. The ultra-rich are defined as individuals who have $30 million or more in assets or earn at least $2 million per household in annual income. They represent just 0.1 percent of the population, yet control more than 20 percent of the nation’s wealth.

Credit: ElizabethWarren.com

There are approximately 150,000 ultra-rich households in the United States, each with more than $30 million in assets and a combined $15 trillion. Ultra-rich individuals who have more than $900 million in assets are classified as billionaires, and they make up a small subset of the ultra-rich. There are roughly 750 billionaires in the United States.

The ultra-rich are also not the “millionaires next door” – small business owners and retirees who have accumulated their personal wealth slowly or through small inheritances. The ultra-rich typically build their excessive wealth through investments like commercial real estate, or by working in industries like tech, finance, and banking. Many hoard their wealth in offshore banking accounts and use other ways to protect their excessive wealth from taxation.

The ultra-rich benefited tremendously from the COVID pandemic and their ranks grew by almost 10 percent between 2020 and 2022. Rising real estate prices and global stock prices meant that they benefited even as millions of Americans lost jobs, life savings, and homes.

While many ultra-rich are celebrated for their charitable giving, much of their philanthropy is usually directed at institutions where they have personal or corporate interests, like university alma maters. Ultra-rich individuals also move much of their excessive wealth into donor-advised funds (DAFs), to avoid paying inheritance and other taxes. Most of their wealth is locked away and does not benefit American families and communities.

While many ultra-rich are celebrated for their charitable giving, much of their philanthropy is usually directed at institutions where they have personal or corporate interests, like university alma maters. Ultra-rich individuals also move much of their excessive wealth into donor-advised funds (DAFs), to avoid paying inheritance and other taxes. Most of their wealth is locked away and does not benefit American families and communities.