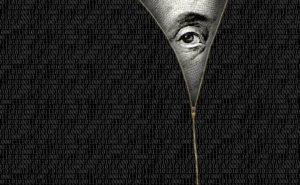

Taxing the Ultra-Rich

There’s a lot of talk about the ultra-rich not paying their fair share in taxes but what does that actually mean?

The ultra-rich do pay taxes, of course, sometimes. But they pay only a fraction of what the rest of us do. That’s because much of their income comes from investments that are taxed at much lower rates than income from work or not taxed at all, which means they get to accumulate a lot more wealth than other taxpayers.

Much of the income that the excessively wealthy receive comes from investments like stocks and real estate that can be taxed at no more than 23%, while the highest income tax rate is 37%.

Much of the income that the excessively wealthy receive comes from investments like stocks and real estate that can be taxed at no more than 23%, while the highest income tax rate is 37%.

The ultra-rich also receive much higher tax breaks for all kinds of things, such as promising donations to The ultra-rich also receive much higher tax breaks for all kinds of things, such as donations to donor advised funds (DAFs)– the law doesn’t require the ultra-rich to give any of their DAF funds to real charity in order for the them to get their tax breaks. In fact, all their tax breaks and ways to hide wealth means that many ultra-rich individuals pay little or nothing in federal income taxes.

There are many social problems that could be solved with proper taxes on this hoarded wealth – an estimated $175 billion a year. For example, $30 billion a year in federal housing vouchers could help end homelessness for thousands of people around the country. And $5 billion a year could end food insecurity for more than 38 million people, including children.

There are many social problems that could be solved with proper taxes on this hoarded wealth – an estimated $175 billion a year. For example, $30 billion a year in federal housing vouchers could help end homelessness for thousands of people around the country. And $5 billion a year could end food insecurity for more than 38 million people, including children.

These billionaires are effectively looting our Treasury. Our policymakers can make changes to tax laws so that the ultra-rich pay what they owe our country. And the general public is overwhelmingly in support of changing our laws for this purpose.

A CNBC survey of millionaires conducted in June 2021 showed that 60% support a wealth tax on people with earnings of $10 million or more.